This text is written for information purposes only and never constitutes a call to action. All financial transactions carried out by you are made at your own risk. The Guarda editorial staff reminds you of the riskiness of all kinds of speculation on all kinds of financial markets.

What is Uniswap?

Uniswap is a kind of a decentralized protocol for automatic liquidity based on Ethereum. Frankly speaking, Uniswap allows you to automatically sell and buy ERC-20 tokens relying on its ability to change the value of tokens.

Why should I trust and use exactly that liquidity pool?

This article is not financial advice. Guarda Team shares its own experience and tries to explain difficult things with simple words. We are warning you that all experience with DeFi may include technical risks, financial risks, governmental interruptions. Any tokenized assets are highly volatile, so conduct all transactions entirely at your own risk. We take care of your funds, and we want your tokens to stay safe and secured directly in the Guarda Wallet.

Why Uniswap?

In complicated words: The most important feature that distinguishes Uniswap from other decentralized exchanges is its unusual pricing mechanism. This mechanism is called the Constant Product Market Maker.

When depositing into a Uniswap wallet, you can use any token based on ERC-20. This way, you launch a new smart contract for a specific token and create a pool of liquidity with a predefined number of tokens and the same value in ETH.

Essentially, Uniswap is a separate ecosystem where it uses a constant equation of the species in order to automatically determine the price of buyers and sellers.

X * Y = K

If we parse the variables, we get the following values: X and Y will be identical to the number of ERC-20 tokens that are provided by the liquidity pool. K is a constant. Essentially, this equation uses the relationship between ERC-20 tokens supply and demand for a particular token.

In simple words: Without going into technical nuances, it is possible to come to the following concept: When a user buys Tether (USDT) for Ethereum (ETH), the offer of ETH increases. The price of USDT will increase when the user buys Tether (ETH) for Ethereum (ETH). In other words, the price of a UNI token can only increase if trades are made. To sum up, we can say that Uniswap leads to a balance of the cost of a particular token through mathematical calculations based on supply and demand.

Earn UNI as a liquidity provider

Where To Start?

So, we’ll start, perhaps, with the most fundamental part – buying ERC-20 tokens. In my case, it will be ETH. In order for us to get ETH on your wallet, you need to open the Guarda application (on any digital device) and go to the Buy tab, where you specify the amount you need in your currency and pay with your VISA or Mastercard.

Invest Or Not?

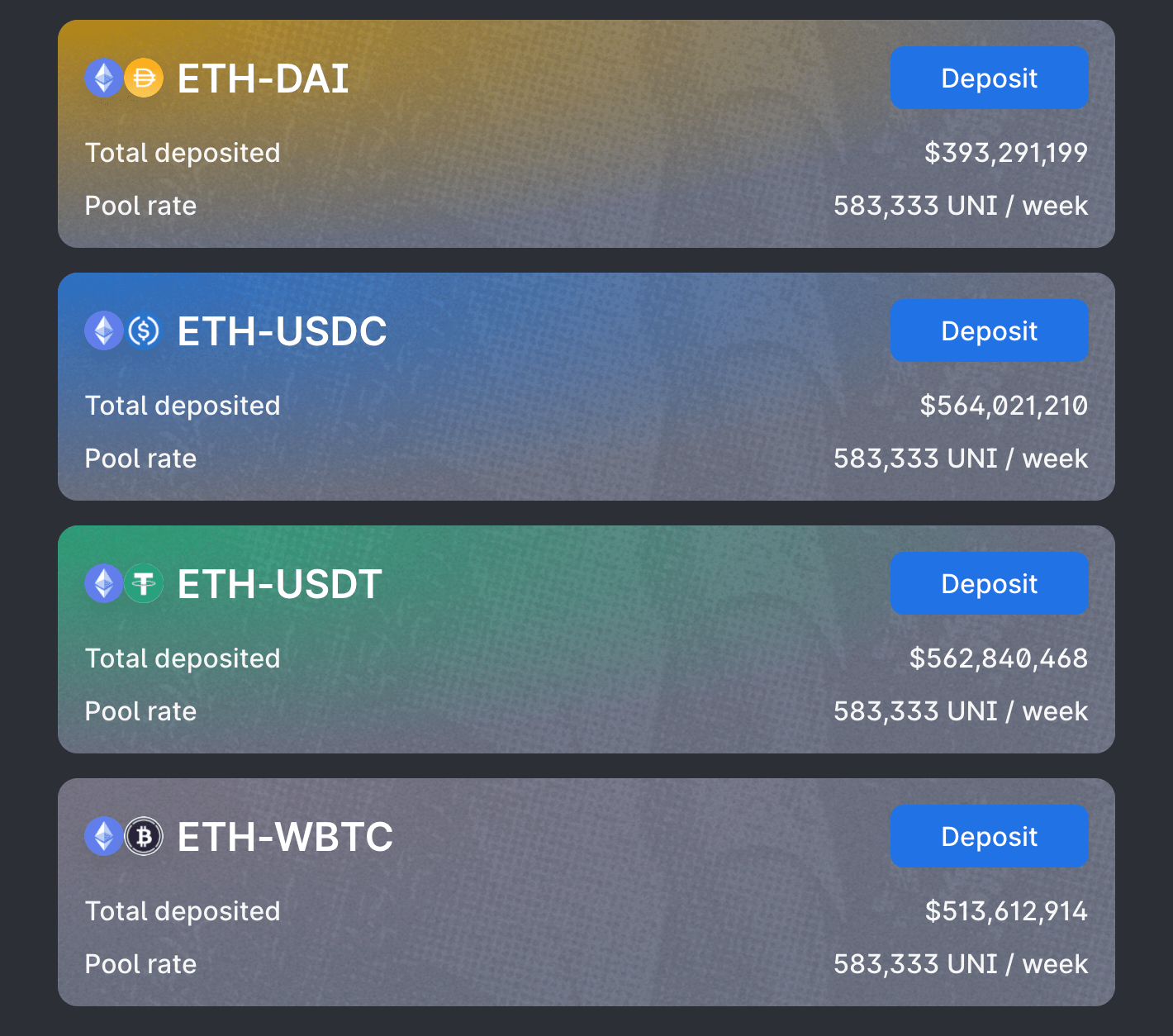

The next point will be to decide whether to invest in a pool or not? We have not yet moved away from mathematical laws even in the crypto world. The more liquidity each pool gets the more competition is to get UNI. So, there are four different pools on Uniswap, and each one is tight to 4 main tokens.

So, the cost of UNI at the time of writing is $3.37 (according to CMC). If we take 583,333 and multiply this numeric value by 3.37 we will get $1,965,832.It is necessary to understand that at the moment pools bring profit, however, everything depends on the cost of UNI. The UNI token is as volatile as any other cryptocurrency, so all investments should be based on technical analysis/experience and in the end (but it’s better not to do that) on your luckiness.

Profits

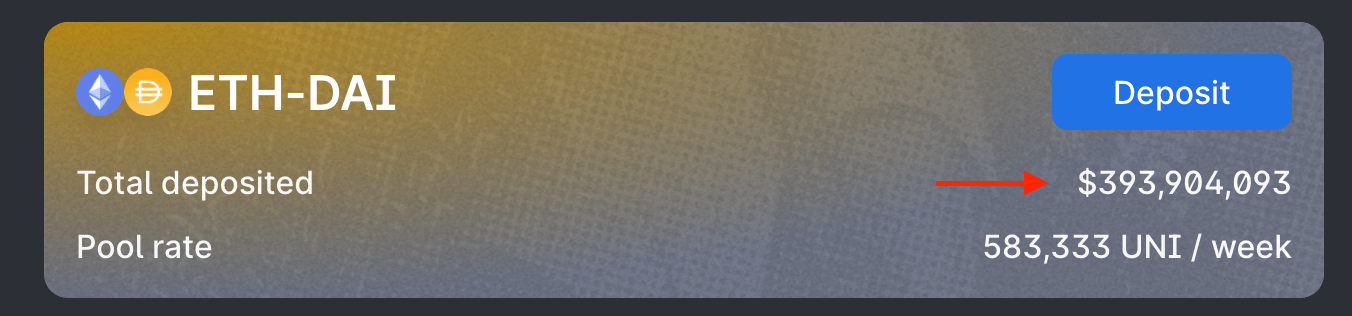

We have four pools, and we understand that each of them brings an ROI, but in which would it be most profitable for us to invest? To tell the truth, you can invest in absolutely anyone. In this case, the less money is invested in the pool, the greater the share of ownership we get. I will not be unsubstantiated, and I will back up the situation with maths – in our case, if we will invest $500 in the ETH-DAI pair, then our share in this pool will be 0.00000126116% (at the time of writing, these figures are constantly changing)

However, do not hurry to close the page. With stable growth and the price remaining, we multiply our part in the pool by the amount by which it increases weekly! And assuming that the amount will remain the same, and there will be no volatility, our earnings in UNI will be about: 0.7 UNI per week. This way, if all conditions are met, we can earn about $3/per week with an investment of $500. Thus, for the remaining 35 days (5 weeks), we will be able to earn 3.5 UNI (≈$14) (with the remaining rate of $3.71). Such a system of yield checking functions works absolutely in all pools, so before you get into any investment pool, calculate every aspect in advance so that you don’t lose your money and the process is worth it.

Earnings

Your earnings depend on how much you have invested in the pool and how much you own it. If you have calculated that this operation will bring you income, then now we will talk about what we should do in that case. Also, when calculating potential payments, which are due to you for investments in liquidity, be sure to take into account all kinds of gas commissions.

Start Farming

The team is working on an update for our extension in Google Chrome, which will soon allow us to experience the DeFi farming. We will notify everyone as soon as the relevant updates are made.

Our application is developed in accordance with high technical standards and follows the latest trends in development by creating our own technologies. Our software allows us to maintain full control and provide a high level of security, so we research in detail the Wallet Connect technology, which interacts with any dApps that we try to avoid for the safety of your funds. Once our analytics department reaches a verdict that this technology is fully secure, we will implement it and allow you to leverage your assets to interact directly with DeFi pools.

Step-By-Step Guide

- At this point, you will have to choose a compatible wallet, and send funds purchased in Guarda to it.

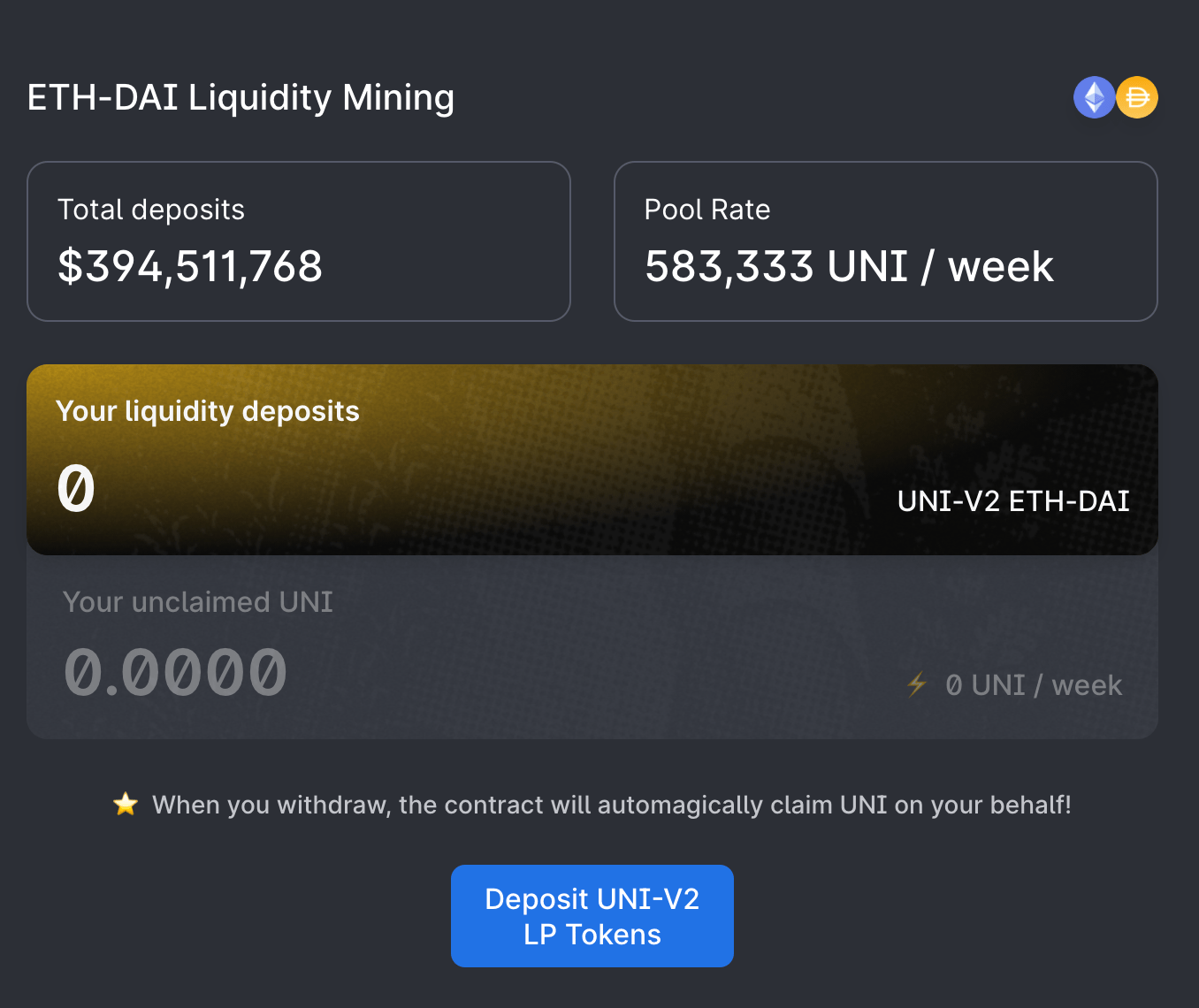

- Our next step is to click the Deposit button of the specified chosen by your pair.

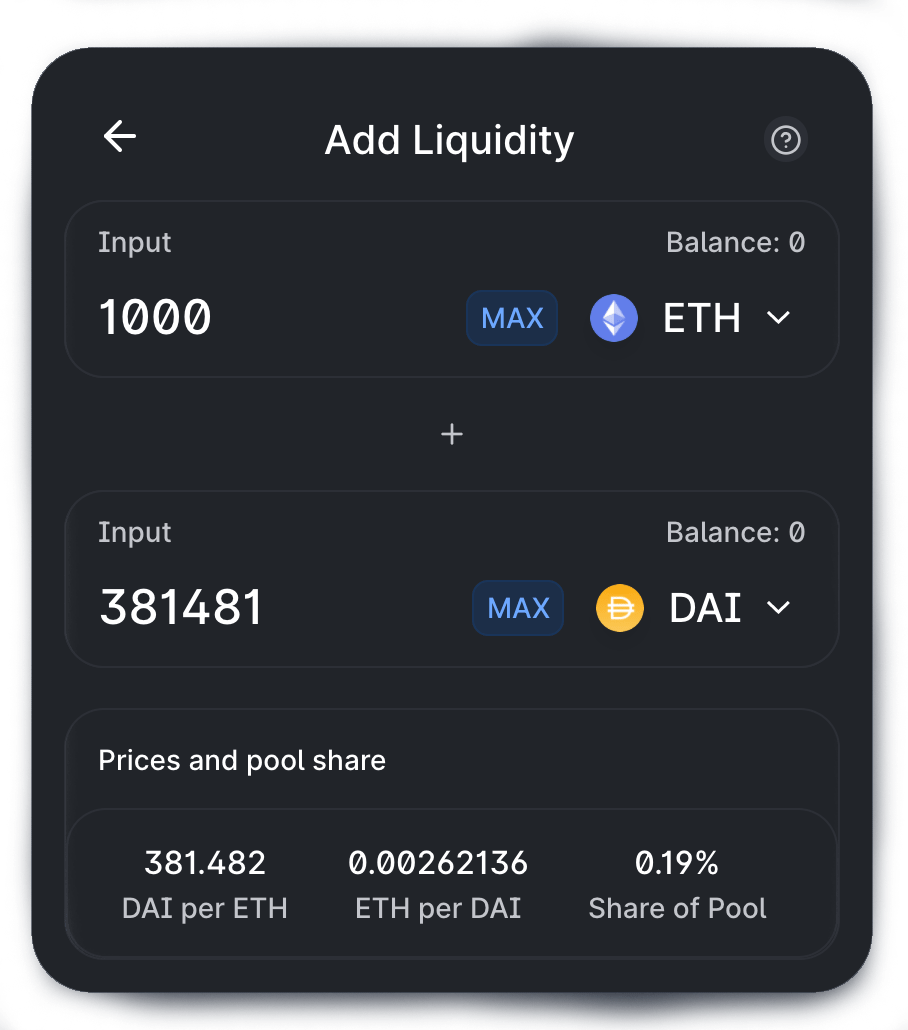

- Then, you get into a tab asking you to deposit liquidity into the ETH-DAI (as an example) pair.

- After that, you will get to the currency pair window, where you have the percentage of ownership in the pool for the amount of investments. How much DAI you will get and other relevant information.

- Once you add a certain amount, in our case, it is 1000 ETH, you get your UNI tokens.

- We should move back to the specified pair page (in our case it’s ETH-DAI), and click on the Deposit UNI V-2 LP Tokens.

- Enter the amount you wish to deposit and click approve.

- Afterward, you will pay a gas fee, and confirm your transaction. (Make sure to wait for the lowest possible commission, because the fees for the issuance of smart contracts are quite high, and you can lose money).

- Then you’re gonna be redirected to the previous page and you should click on the Deposit, where you will pay another gas fee.

- Once you have confirmed your deposit, you start earning UNI tokens as a liquidity provider!

- Good luck! We wish you success in the world of DeFi farming. Stay with us, there are many more interesting things from the DeFi world ahead of us. Uniswap is just a small portion of the huge cycle of the global financial instrument.

Also, we would like to make a small remark. Please, remember that there is a network fee for transactions and gas commissions for issuing smart contracts