This text is written for information purposes only and never constitutes a call to action. All financial transactions carried out by you are made at your own risk. The Guarda editorial staff reminds you of the riskiness of all kinds of speculation on all kinds of financial markets.

What is Yearn Finance?

Yearn.Finance has become one of the most popular players in the DeFi ecosystem. It is a yield aggregator that provides automated growing strategies for farmers and liquidity providers.

How can I get YFI tokens?

There are 3 ways to earn YFI tokens:

- The first method involves adding a mixture of about 98%-2% DAI and YFI to the Balancer protocol. In the future, this can be exchanged for BAL (Balancer protocol) tokens instead. Then these BAL markers are deposited in YGov in exchange for YFI.

- The second method involves depositing a stable coin in annual financing. It is then automatically converted to a similar number of tokens, which can be used to earn YFI tokens.

- The third method involves depositing a mixture of YFI and yCRV on the Balancer exchange. This is exchanged for BPT (Balancer pool) tokens. Then they are deposited in YGov to acquire YFI tokens.

How to buy YFI tokens?

- If you want to buy YFI tokens on a decentralized exchange without creating an account/KYC, you can use Uniswap or Balancer.

- If you want to use a centralized exchange, you can use exchanges like Poloniex and CoinEx to buy YFI tokens.

Distinctive features of YFI token

Yearn Finance platform provides the opportunity for crypto holders to participate in Yield Farming by interacting with DeFi-protocols. Farming on a blockchain is similar to the usual planting of seeds in the ground for their multiplication.

To harvest from the DeFi platform yearn.finance, you need to bet on a cryptocurrency. YFI tokens are distributed among platform participants as a reward.

Step-by-step guide of earning YFI token

Section 1: Earn

- So, we’ll start, perhaps, with the most fundamental part — buying ERC-20 tokens. In our case, it will be ETH. In order for us to get ETH on your wallet, you need to open your Guarda Wallet (on any digital device) and go to the Buy tab, where you specify the amount you need in your currency and pay with your VISA or Mastercard.

- The next one is to go to yearn.finance website, where you’re going to see this panel.

We have 6 categories, each is responsible for its own function. Let’s now talk about each one of them:

We have 6 categories, each is responsible for its own function. Let’s now talk about each one of them:

- Dashboard: Get a quick glance at how your portfolio is growing while invested in yearn’s products.

- Vaults: Vaults follow unique strategies that are designed to maximize the yield of the deposited asset and minimize risk.

- Earn: Earn performs profit switching for lending providers, moving your funds between dydx, Aave, Compound autonomously.

- Zap: Zaps help you save on gas fees. Zap directly into or out of Curve pools from the base assets.

- Cover: Get cover for insurance risks with Nexus Mutual from yinsure.finance

- Stats: Get a quick glance at how yearn’s vaults are performing.

- Once you have purchased ERC-20 tokens, you need to tie your wallet with Yearn Finance. In order to do this, you need to go to the Yearn Finance website, and after choosing the Vaults category, connect a compatible wallet to the app.

- So, connection to them is made through Web 3.0 wallets. Firstly, you have to click on the Connect your wallet button, where you need to select a compatible wallet and send your funds from Guarda to the one presented on the Yearn Finance website.

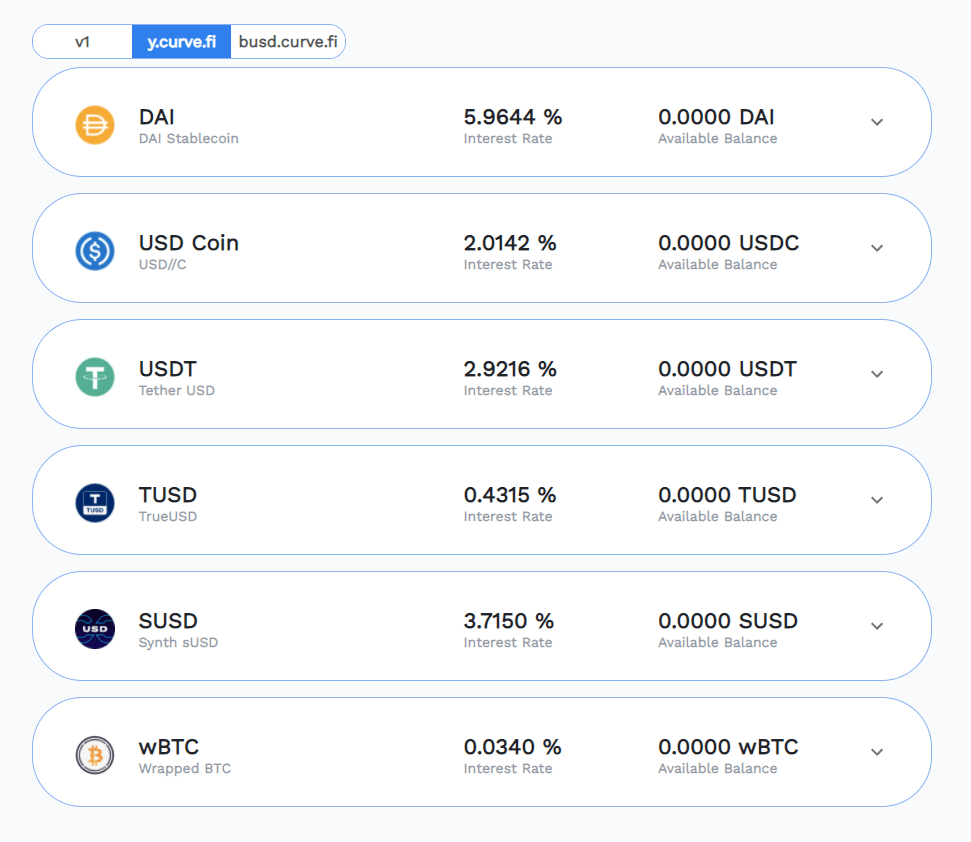

- When your wallet is connected, you can deposit any of these stablecoins. Yearn will get you the highest yields for your coins by shifting your coins between popular pools.

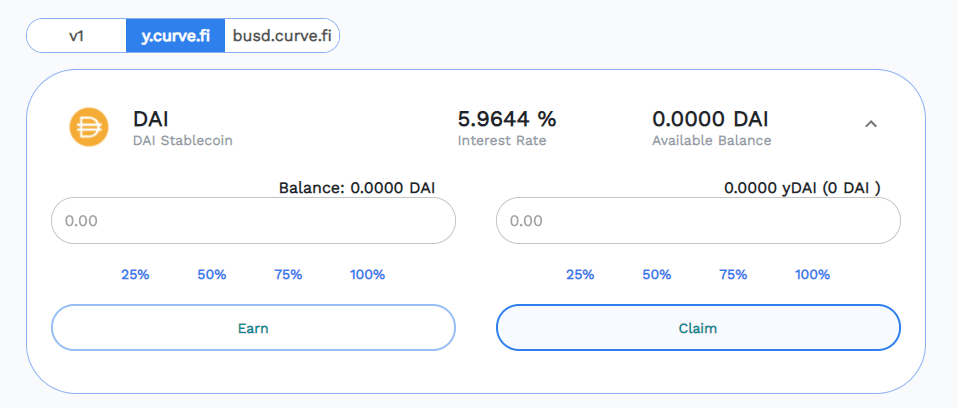

- Okay, as for now, we’re going back to the “Earn” page and looking for a token to deposit in. We are going to take DAI as an example.

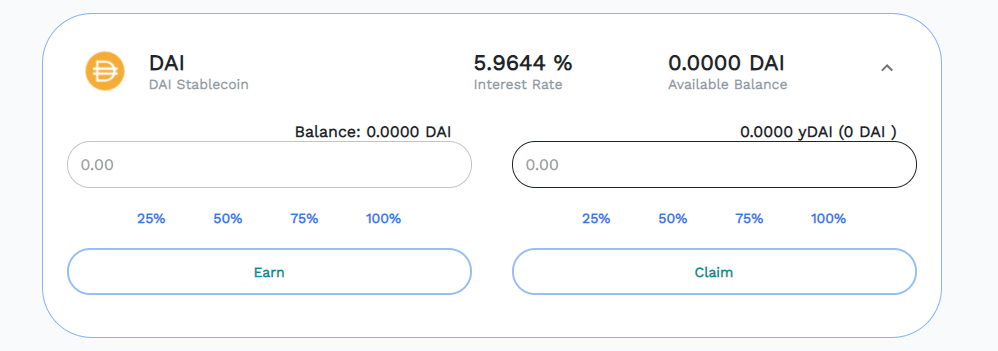

So, for now, if we want to enter the yearn.finance pool with DAI, we click on the dropdown. In the dropdown, we can enter any numerical value you want for your investment, or we can select a percentage of your balance.

- Once you have made a deposit, Yearn (algorithmically) will allocate your investment into one of three pools. Then, it will withdraw funds from one protocol, and make a deposit to the other in an automated mode, as soon as the algorithm sees the interest rate change. Yearn will automatically select the most profitable pool for you and allocate your investments.

- On the same principle as in all other pools, you get tokens back, which correspond to your degree of ownership. In order to get them, you have to click on the claim button.

Section 2: Vault

Vaults form strategies to operate the most profitable strategies for Yield farming and minimize all kinds of risks. It was built so that the community cooperates and develops new stratagems to extract the most profitable way to invest their money.

Roughly speaking, Yearn Vaults are pols of funds with an associated strategy to achieve the highest return on investment.