This text is written for information purposes only and never constitutes a call to action. All financial transactions carried out by you are made at your own risk. The Guarda editorial staff reminds you of the riskiness of all kinds of speculation on all kinds of financial markets.

What is Compound Finance?

Compound Finance is a project that algorithmically implements money markets. It allows generating markets where it is possible to lend assets and borrow them (basing these loans on collateral) so that the interest rate is calculated block by block according to the Supply and Demand in an algorithmic way.

Compound comes to create a market where the interest rate is defined algorithmically by supply and demand, practically to the second, to lend or borrow assets. Here the protocol advances a little more with respect to what we are used to in the real world.

What are the distinguishing features of Compound?

- The Compound protocol is not similar to a traditional bank and does not transfer user data to other users. Instead, it provides market liquidity for tokens and users can borrow from this market. Demand and supply determine the interest rate in each market.

- When users provide tokens for a complex protocol, it uses cToken to represent them. cToken is the main token in the protocol, and all negotiation, transmission, and programming processes are based on it.

- The automated nature of the Compound protocol allows you to calculate the interest rate on holdings. Interest rates are updated with each production of the Ethereum block lasting about 15 seconds.

Step-by-step guide on earning COMP token

- So, we’ll start, perhaps, with the most fundamental part — buying ERC-20 tokens. In our case, it will be ETH. In order for us to get ETH on your wallet, you need to open your Guarda Wallet (on any digital device) and go to the Buy tab, where you specify the amount you need in your currency and pay with your VISA or Mastercard.

- Once you have purchased ERC-20 tokens, you need to tie your wallet with Compound Finance. In order to do this, you need to go to Compound Finance website, and on the main screen click on the App button.

- The next step is about the connection to the wallet. So, connection to them is made through Web 3.0 wallets. Firstly, you have to click on the Connect Wallet button, where you need to select a compatible wallet and send your funds from a Guarda wallet to the one presented on the Compound website.

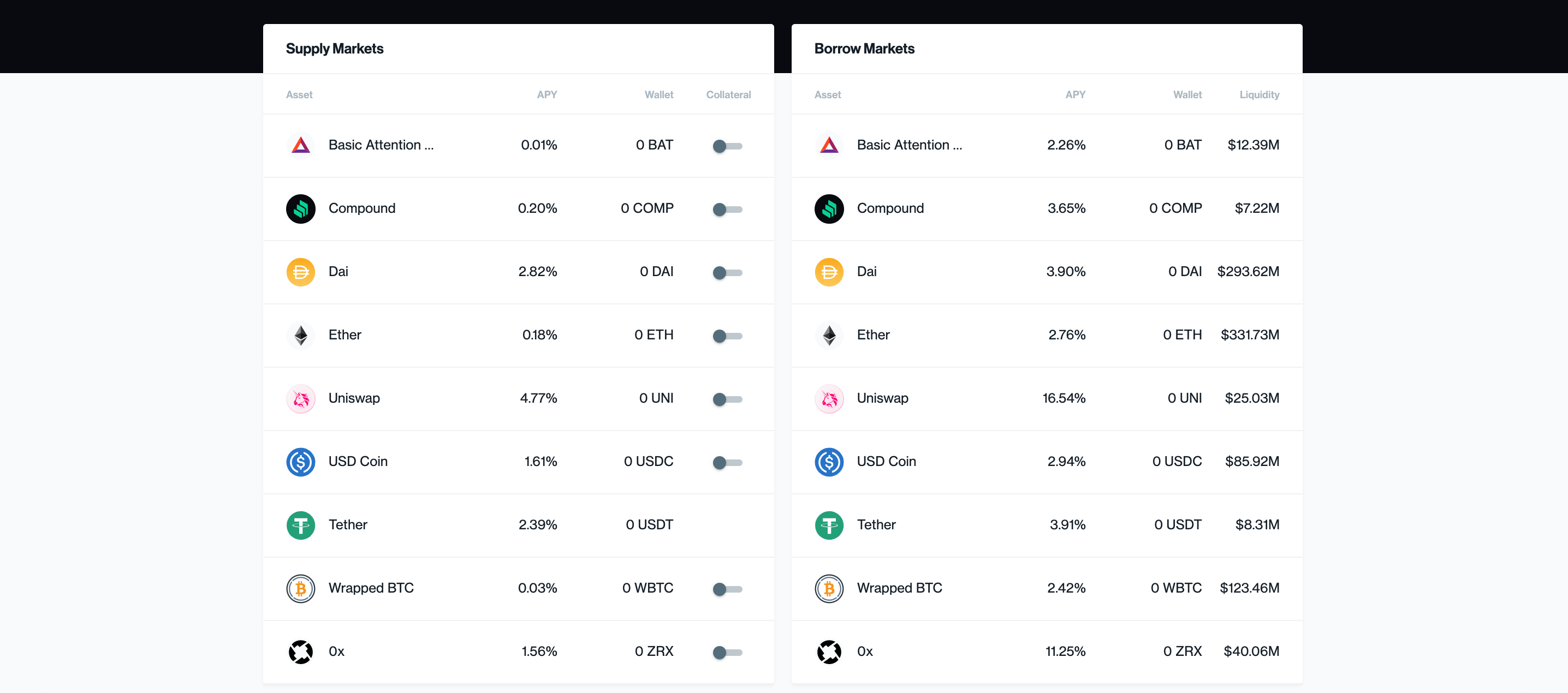

- After the connection, a panel opens with a list of available cryptocurrencies, their balances, and interest rates on Supply and Borrow.

- Then, in the control panel, you need to select which cryptocurrency to put (deposit) on the platform. Compound rewards its users both for providing assets for credit (Supply) and for obtaining credits (Borrow). To get the most out of it, users take both sides of the deal. They make a deposit, take out a loan, and deposit it again.

- Earnings are also done through the use of cryptocurrency on the platform as collateral in order to borrow money. Borrowing funds also requires the payment of commissions. For example, getting a loan in Uniswap tokens will cost the investor 27,34 % per annum.

How Do I Get Compound, after all?

COMP is earned through interaction with Compound Tokens. COMP is accrued automatically as assets are provided or borrowed via the protocol. To find out how much COMP you have collected (or earned), just go to the voting control panel. Here you can Collect COMP for voting.

Note: COMP is automatically collected when assets are withdrawn from the protocol. If you want to save on gas, just remove any asset by 1 dollar and COMP will be collected automatically.

All operations in Compound are performed in two steps - send a request and confirm the transaction in the wallet application you are using.

Other ways to earn profit with Compound

In addition to receiving dividends from the interest generated by our deposits, Compound can be used as a tool that allows us to profit by buying and selling crypto assets between Compound and external exchanges.

Long positions arise when you buy a certain amount of an asset and wait for its value to rise and then sell it. On the other hand, a short position occurs when you own a certain amount of assets and decide to sell them, waiting for their value to fall, and then buy back more of the original asset at a lower price.

Conclusion

Compound Protocol sells the Ethereum asset market, which allows users to earn interest or borrow such assets by depositing collateral that is used as collateral. Anyone can provide assets to Compound’s liquidity pool and immediately start receiving compound interest on an ongoing basis. Interest rates are automatically adjusted according to demand and supply. The balances of the provided assets are represented by cTokens tokens, which represent interest representations of the underlying asset and serve as collateral. Users can add or remove funds at any time, but if their debt becomes poorly secured, anyone can repay it.

As a consequence of the above, Compound Protocol offers a number of features with great potential that can revolutionize financial business models built on the Ethereum ecosystem, allowing developers to create innovative products in the DeFi ecosystem.