Introduction

A key aspect of cryptocurrency usage is the method of storage, which often becomes a critical consideration for users. Beyond basic functionality, modern crypto wallets have evolved into multi-featured tools for managing digital assets, offering more than just storage. Many of the best crypto wallets now provide services that rival those of traditional crypto exchange platforms, including features like instant swaps and fiat purchases.

This development has blurred the line between wallets and exchanges, with advanced wallets offering a more comprehensive experience for users looking to manage their crypto holdings efficiently. In this article, we will explore the key differences between a non-custodial crypto wallet like Guarda and a traditional custodial wallet built into a best crypto exchange platform.

By examining these differences, we aim to identify the best wallet for crypto storage and management based on factors such as the amount of crypto held, preferred device, and user experience in the blockchain space. Ultimately, understanding these distinctions will help users choose between crypto to crypto exchange services and wallet-based management, ensuring their assets are stored and handled in the safest and most efficient manner.

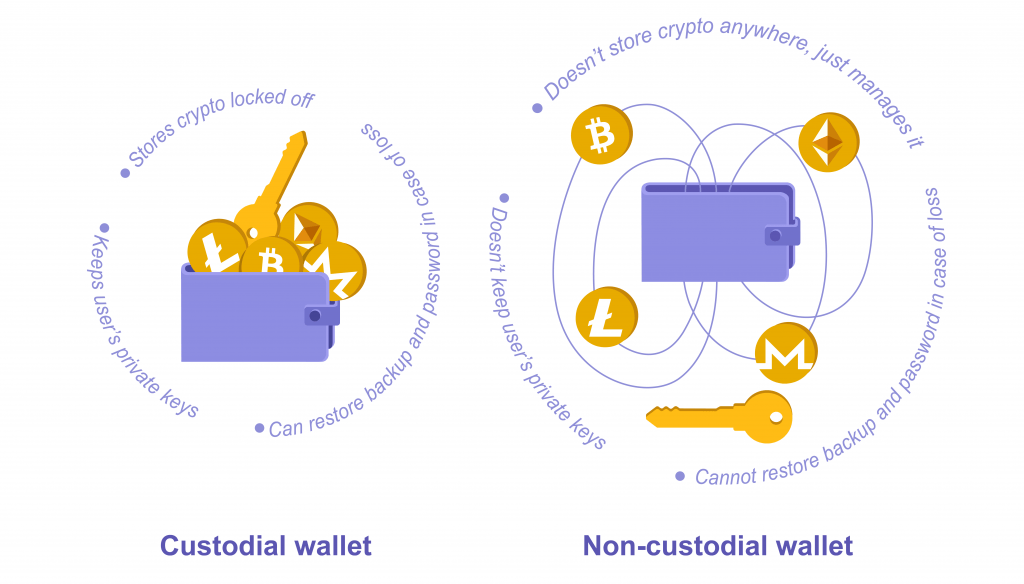

Custodial vs Non-custodial Services: General Comparison

Specialized terms are defining the two fundamentally different working principles according to the type of storage: while the exchange built-in wallets are custodial, Guarda Wallet is non-custodial. The latter can also be called “lightweight” or “light” since it keeps neither your private keys nor your data and, therefore, doesn’t lock off your money in any kind of vault. It’s rather a handy tool for managing assets than storage in its classic form.

Specialized terms are defining the two fundamentally different working principles according to the type of storage: while the exchange built-in wallets are custodial, Guarda Wallet is non-custodial. The latter can also be called “lightweight” or “light” since it keeps neither your private keys nor your data and, therefore, doesn’t lock off your money in any kind of vault. It’s rather a handy tool for managing assets than storage in its classic form.

Custodial wallets and services, on the contrary, have access to all your data and crypto-assets respectively. This means you’ll never have full control over your funds as long as you’re using one of the built-in exchange wallets. Yes, they can be good to some extent (especially for novices) but all in all, they function similarly to traditional banks with all their disadvantages and risks multiplied on the cryptocurrency market volatility. At this point, you should ask yourself a reasonable question: “Do I trust the exchange platform enough to shift the responsibility for my funds?” And surely, deep inside you understand that no one can protect the money better than its owner.

Custodial services

It’s worth mentioning that custodial wallets still have their advantages. They allow managing your funds easily anytime you have an Internet connection. Moreover, there’s no chance of losing your private keys and, thereby, access to the money.

But the list of disadvantages will be much longer – this makes exchange wallets a questionable choice. First of all, custodial wallets have control over your funds since they keep your private keys, as we noticed before. If the wallet appears to be a scam or involved in some kind of fraud, you’ll inevitably lose the investments. Your crypto can also be seized by a court decision or stolen by hackers. And even in case of a fork, there’s always a possibility of money loss caused by technical issues (just because it’s locked off in this type of wallet).

Choosing a custodial wallet, you shift responsibility for your funds on to a third-party. Hence, in the situation of password or backup loss, the company can easily restore either of them for you. This can be handy for a beginner but, in fact, the deeper you go into the crypto jungle, the more you value privacy and independence. You can already observe the same trend happening in other spheres of our life: while a few years ago, people eagerly left their contact information in exchange for free samples or an extended trial period, now they always choose anonymity and are ready to pay for it. Indeed, leaving your wallet keys to a stranger company seems irrational when you’re living in a world where even the shielded crypto transactions already exist…

Here are some examples of popular exchange platforms that offer their custodial wallets for storing your crypto:

- Binance is a global trading platform working with over 100 cryptocurrencies. By the beginning of 2018, it became the biggest crypto exchange in the world according to the trading volume. Still, it couldn’t protect the users’ funds well enough and lost 7.000 BTC in 2019 due to the hacker attack.

- Huobi claims to be “the most secure digital currency marketplace” and steadily attracts cryptocurrency hodlers. Nevertheless, the beginning of 2019 became disastrous to one of them: the huge Chinese investor lost 5.4 BTC as a result of a wallet hack.

- Coinbase is a digital currency exchange headquartered in San Francisco, California. They broker exchanges of Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Tezos, and many others, with fiat currencies in approximately 32 countries, and bitcoin transactions and storage in 190 countries worldwide.

Non-custodial services

A custody-free wallet can become a great storage solution both for a beginner and an experienced cryptocurrency user. Nevertheless, the novices are often frightened so much by the technology itself, the flood of new information, the wallet’s interface and surprisingly big responsibility that they prefer to stick with the less reliable in some ways custodial services. But once you fully understand the advantages of decentralization and privacy, you’ll never want to go back to the traditional model of storing money.

Let’s start with the basics: the main idea lying behind cryptocurrencies is decentralization. Building a decentralized economy implies a division of responsibilities between all the active members of the process. Thus, there should be no central authority keeping your money and capable of taking it from you freely.

Normally, all the crypto assets like Bitcoin, Ether, Litecoin, etc. are stored on the respective blockchains. The information about your balance is contained in a particular block together with the details like creation time and so on. It can be seen with the public keys but still cannot be altered. This means that knowing your public address a person can send you crypto but cannot transfer your money somewhere else. Your private keys, on the contrary, hand in the full control over your funds. That is why it’s always recommended not to share them with any third-party services or physical persons and store them in a safe place. “If you don’t own your keys, you don’t own your coins” – the rule originally formed for Bitcoin is also true for all the other cryptocurrency assets.

If you don’t own your keys, you don’t own your coins

It’s more of prejudice that a light (custody-free) wallet is a product designed precisely for advanced users. The Guarda team takes care of the customers and considers it essential to provide them with a friendly interface. That is why all Guarda wallets (no matter Web, Desktop, Mobile or Chrome Extension version you get) are simple and clear in terms of user experience.

The only challenge that a cryptocurrency holder faces is the necessity to keep the private keys safely, away from the public eye and various technical threats. The user oneself is fully responsible for the wallet’s password and backup file as the non-custodial service provider can see neither of the two and, therefore, cannot restore them in case of loss. Well, money in combination with anonymity gives truly great power, and with great power comes great responsibility, as you know.

Crypto brokers like Anycoin recommend using a wallet like Guarda to store your own crypto’s.

Here are the types of non-custodial wallets:

- A web wallet is perfect as a basic version. In this case, your private keys are stored in the browser. With such wallets as Guarda and MyEtherWallet, it is possible to access the account from any device connected to the Internet by entering the private keys.

- A desktop wallet is a handy option for those who value their time and are used to managing crypto on the go. Such applications can be easily installed on a smartphone or a tablet in just a few clicks, though you should be extremely careful while choosing the one. Pay attention to the customer reviews in the dedicated stores (App Store or Google Play) and check the developer’s answers as well to find out the trustworthiness of the service. When you finally made a choice, go to the developer’s website and download the app from the link given there to avoid getting fake software (it’s a widespread kind of fraud, beware).

- Hardware wallets are known to be the most secure and reliable cryptocurrency storage solution on the market right now. These physical devices look similar to flash-drives and provide you with the so-called “cold” type of storage since they are not connected to the Internet.

- Paper wallet usage can be compared to storing money under the mattress – it’s secure, of course, but rather inconvenient. In this case, you print or put down both public and private keys on a piece of paper, and store your money off-line. Anytime you need to send, buy or exchange it you just import the keys into a trustworthy wallet.

Transaction algorithm

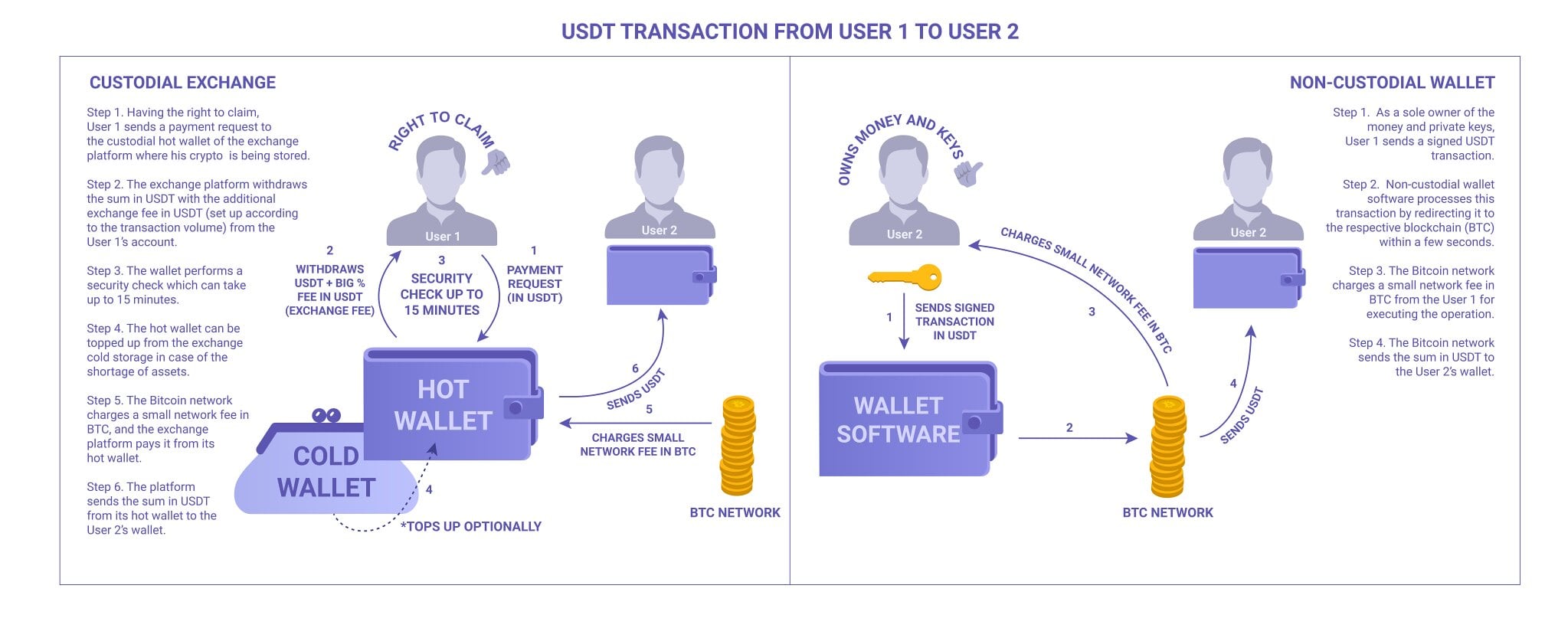

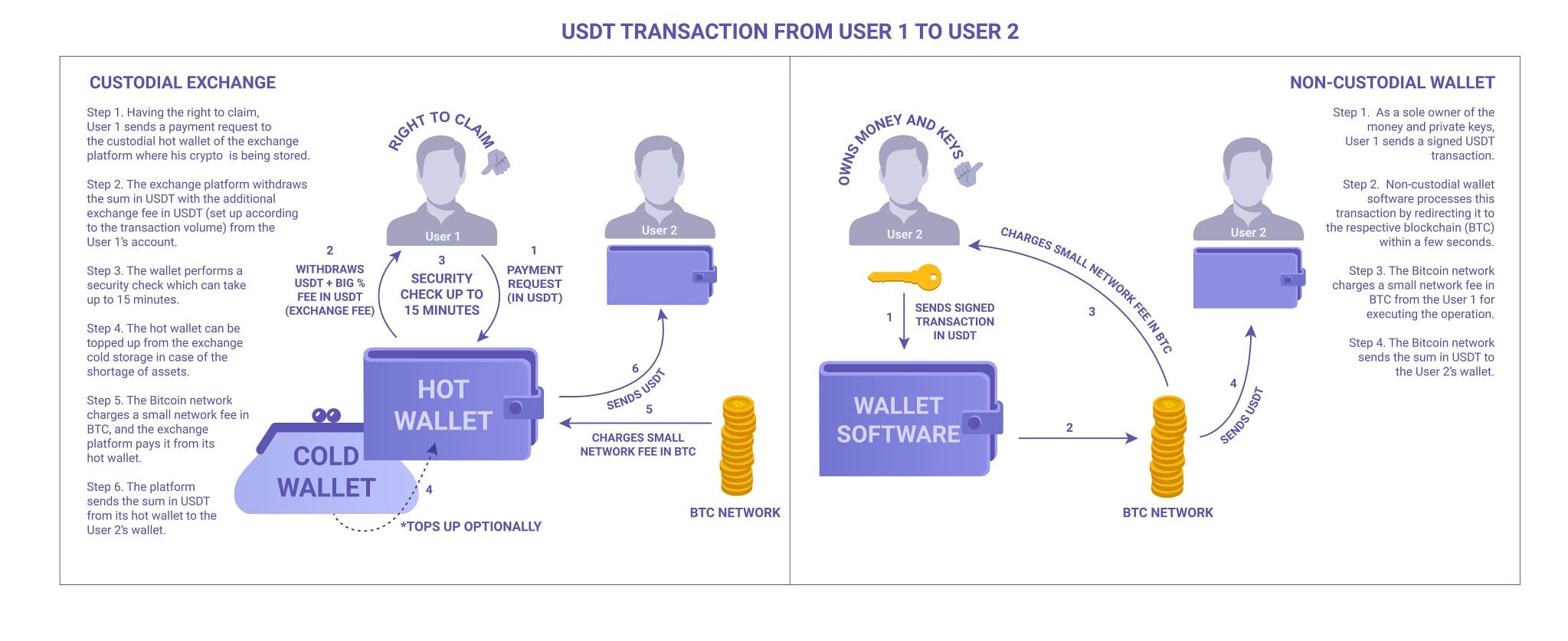

In this section, we’re going to address the two contrasting scenarios that take place in case of performing a crypto transaction through an exchange platform and through a non-custodial wallet respectively. Scenario 1 involves acting with the exchange assistance, while Scenario 2 implies using the multi-featured lightweight wallet only. In the first case, you give the exchange access to your private keys and the funds respectively, the same way as it happens within the traditional banking system. In the second case, you’re holding the private keys as a sole owner. Surely, both variants have their pros and cons. To understand the peculiarities of each method and choose the one that fits your purposes better, take a look at the schemes above and learn some extra details from the next two paragraphs.

What about the transaction speed?

Vastly increased transaction speed was originally one of the main advantages of blockchain technology in comparison to the traditional payment system. Enormous waiting time comprises various validations that can take a while, for example, because of the difference in working hours of the financial institutions involved. To avoid this kind of issue, blockchain technology made it possible to get validation 24 hours a day at any location. Still, there’s some difference in processing time according to the service you use to transfer your funds.

As you see from the schemes, Scenario 2 (Non-custodial wallet) appears to be more beneficial than Scenario 1 (Custodial exchange) in terms of speed. While a single transaction with the help of a non-custodial Guarda wallet can be performed almost immediately (the amount of time depends on a particular blockchain), the same operation via an exchange platform will take about 15 minutes to complete.

A custody-free service addresses the respective network as soon as it gets a request from the user. It doesn’t keep coins anywhere and, therefore, doesn’t spend time on verifications and security checks within its system. “Custody”, in its turn, means storing assets in a sort of pool, hence, it takes a certain time depending on the volume to make a security check and only then to redirect the user’s request to the network.

What about the transaction fees?

When performing a crypto transaction you cannot escape paying those disturbing commissions. In Scenario 1, an exchange platform charges you for its assistance in reaching a blockchain network. Depending on a sum and particular cryptocurrency, the fees may vary a lot but generally, they are taken in percentage and appear to be much bigger than pure network fees. As well as the amount, the currency in which the commission should be paid is chosen by the exchange platform.

There are four common types of fees charged by most popular exchanges:

- Maker fee

- Taker fee

- Deposit fee

- Withdrawal fee

The first two kinds (maker fee and taker fee) also known as trading fees take part in the exchange process which we’ll explain in the next section. Simply remember that the amounts are usually arbitrary and exceed the network fees several times.

The deposit fee is related to storing cryptocurrency assets in the exchange custodial wallet. Those holders who keep really big sums on their accounts have a chance to get a discount from the exchange since it is strongly interested in such clients. Their investments provide the platform with the possibility of performing fast exchanges.

Withdrawal fees often appear to be bigger than any other, for the exchange tries to hold as many users on the platform as possible. Making withdrawal extremely expensive, it encourages crypto enthusiasts to remain their loyal clients longer.

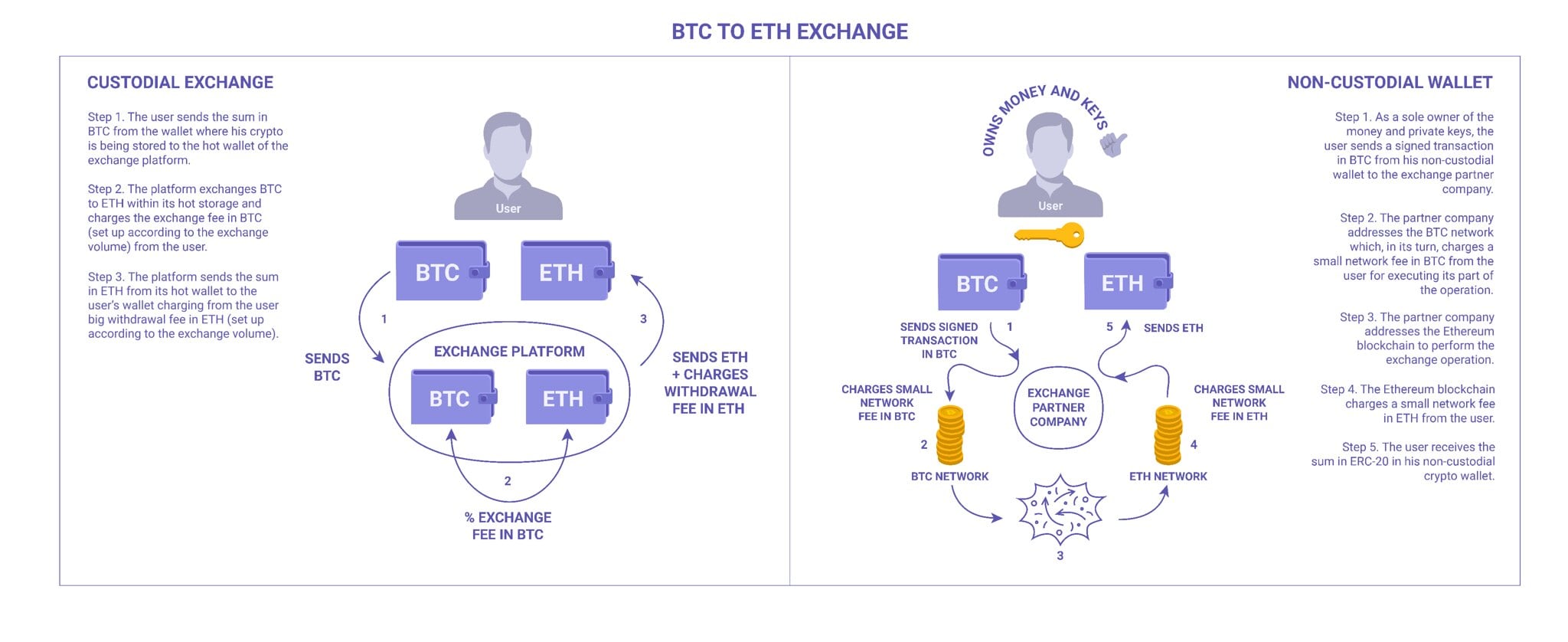

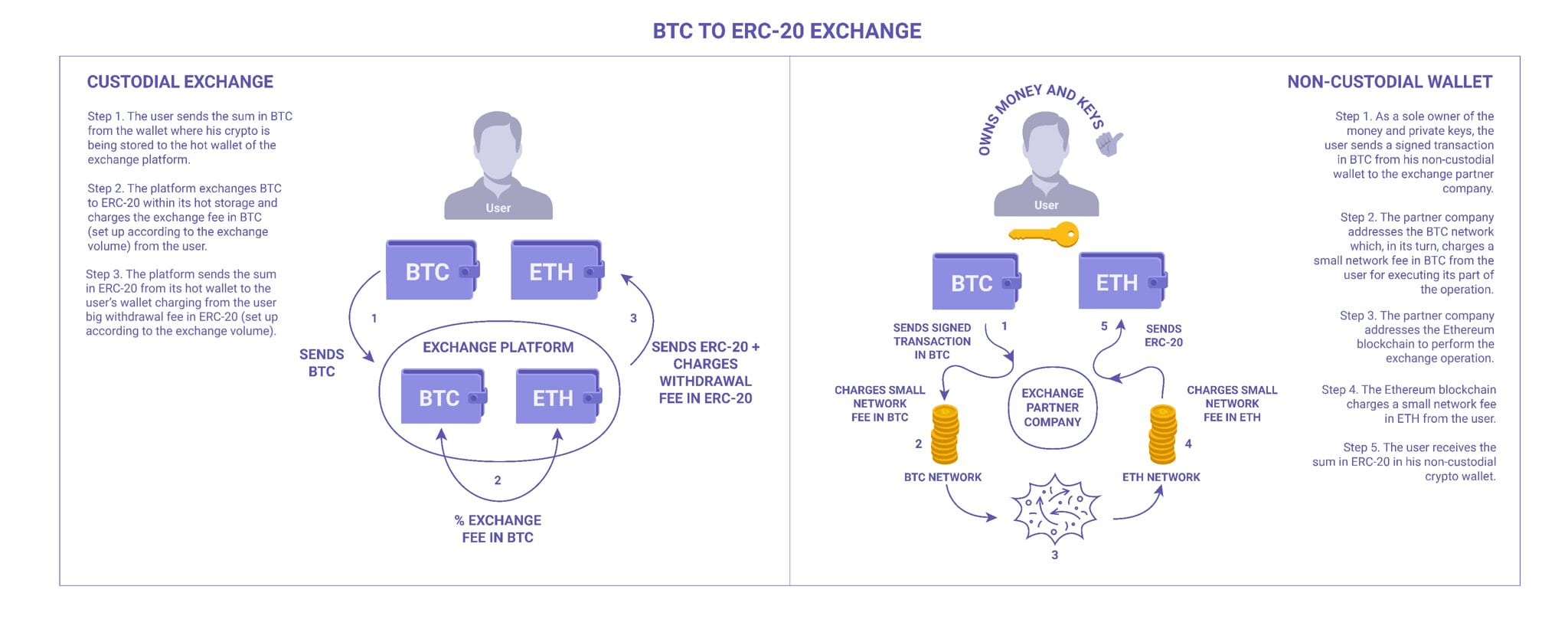

Exchange algorithm

After figuring out the specifics of cryptocurrency transactions through custodial and non-custodial services, let’s turn to the way they perform cryptocurrency exchanges. In Scenario 1, the user stores crypto coins directly on the exchange platform – locked off in its custodial wallet. Thus, the exchange as an operation happens within custodial storage that keeps the savings of all users together.

Non-custodial Guarda, in its turn, implements Scenario 2 when the user’s request is redirected to the partner exchange company and further – to the respective blockchain networks.

The first way seems easier, definitely, but ask yourself: “Am I really in charge of my funds storing them in the built-in exchange wallet?” And the next question will be: “Do I trust the exchange platform enough to let it keep my assets?”

In fact, we observe that experienced cryptocurrency holders tend to keep and manage funds in stand-alone multi-featured wallets like Guarda.

What about the exchange speed?

When it comes to the exchange speed, the popular platforms such as Binance, ShapeShift and Poloniex turn out to be in a stronger position in comparison to non-custodial wallets which provide built-in exchange service: they are capable of performing this financial operation in just a few seconds, while the waiting time on Guarda could be significantly longer. Let’s figure out the reasons lying behind this discrepancy.

As we already mentioned, the custodial storages of major exchanges work like traditional bank vaults. Hence, when you send a swap request, the exchange can fulfill it immediately by transferring someone else’s money to your address. We marked it as Scenario 1. You can follow the process step-by-step in the picture above.

Performing a cryptocurrency exchange operation within a non-custodial wallet like Guarda in Scenario 2 will imply an alternative scheme of actions. Since Guarda doesn’t have access to the users’ funds, it cannot roll their crypto back and forth so swiftly as any exchange can. Thus, Guarda as a wallet provides the exchange service with the assistance of its partner company (ChangeNOW or CoinSwitch, depending on a particular pair) which, in its turn, addresses the respective networks. Though this algorithm is more transparent and, therefore, reliable, it requires a longer time to execute. But when it comes to a financial sphere, any haste can only lead to negative consequences. If a few extra minutes constitute the price of privacy and security, we’re certainly able to pay it.

What about the exchange fees?

It seems there’s no other search request or hot topic that could compare with “exchange fees” in relevance. Discussed intensively on social media, community forums, and crypto meetups, this inevitable evil of the system rightly becomes the defining factor for the majority of customers. The users, showing interest in this aspect, prefer one platform to another according to the fee amount but they often forget about the root of the root: all the exchanges earn money right from these commissions. Thereby, they overcharge clients on a normal basis establishing arbitrary prices for their service.

Trading platforms play the role of a mediator in this scheme. Typically, they charge a certain percentage of the transferred sum for their assistance and pay the network fees from their own pockets (well, from the pockets of their users, to be exact). Collecting the fees in percentage allows these platforms to make a fortune on big clients. For that reason, small transactions appear to be more beneficial to make on major cryptocurrency exchanges (Scenario 1). The problem is that in the current stage of market development, we still cannot use Bitcoin, Monero or, say, Dash freely for daily purposes. Thus, the necessity of micro-transactions falls away and we return to the most prevalent function of cryptos – valuable assets – which means that a chance to benefit from exchanging coins and tokens this way is extremely small.

Non-custodial Guarda that represents Scenario 2, by contrast, doesn’t charge for its use: it has no extra fees above the commissions of the respective networks (Bitcoin, Ethereum, Monero, etc.) in case of exchange operations. The option which is sometimes called “withdrawal” (mind that it’s technically incorrect since non-custodial wallets don’t store coins and tokens) is also free on Guarda: you can always export your private keys from Guarda and import them the user into any other wallet at no cost. On the popular buying/selling or exchanging platforms, the same operation tends to be enormously costly since those companies aim to tie up the clients for a long period. Unlike the exchange commissions, the relevant network fees remain almost stable. This is especially advantageous when it comes to managing big sums of money because your transaction fee appears to be the same no matter how much crypto you’re going to exchange.

Though users can control the amount they are willing to pay as network fees to the miners, this directly influences the speed of the exchange. The lower the price you choose, the longer it will take for your transaction to be verified. Thus, before setting the amount, it’s recommended to get familiar with the average numbers for the particular blockchains you’re going to work with.

One more nuance you have to consider is the form of those network fees. For example, you need to exchange some kind of Ethereum-based tokens (say, ERC-20) within Guarda Wallet. Then it’s necessary to have some ETH as well on your account since the fees are taken by the network in its native currency. The same situation occurs when you manage Tether (USDT) which is built on the Omni Layer protocol of the Bitcoin blockchain and, therefore, requires having BTC in the wallet. Since each exchange operation involves two sides in the process, you have to take into account the requirements of both networks to perform everything correctly.

Summary

Now, after looking through all the schemes, tables, and lists of features, you hopefully understand better the core difference between custodial and non-custodial services not only in terms of storing crypto but also in terms of transferring and exchanging it. There cannot be a clear response to the question “Which of the two working principles is better?”. We can only highlight the advantages and disadvantages of both methods and let you decide for yourself which one suits your purposes in each particular situation. Are you looking for speed transactions? Maybe, you simply want to find the service with the lowest fees? Is it possible that you lose the private keys? How much is privacy important to you? Everything will influence the final choice. And lastly, the Guarda team strongly recommends paying special attention to the type of storage you use and clear up all the questionable details beforehand by conducting research on the Internet and consulting experts any time you’re going to try a new service to learn from harmless articles instead of sad personal experience.