Introduction

As you might already know, transactions in cryptocurrency come with fees presented by the network. It happens that the services take their transactional fees for sending and receiving cryptocurrency but in the case of a non-custodial wallet like Guarda this does not happen. So, the question is – how are the fees calculated and what are we all paying for when sending cryptocurrency transactions?

What are transaction fees for blockchain?

The commission conditions vary for each particular network – this depends on the technology itself. Now, let’s check a couple of examples of network fees.

How does Bitcoin network fee work?

Bitcoin is, for sure, the most widespread example here. As pretty much everybody knows, BTC cryptocurrency resides on a blockchain – a growing list of records comprised of blocks (surprise!). Each of the blocks contains a hash of the previous block, timestamp and transaction data. When it comes to Bitcoin, an average of one block in approximately 10 minutes can be created. The miners pick the transactions to be included in the upcoming block. For this, they get a reward in BTC. The system works quite simply – the higher the fee, the bigger is the priority of a taken transaction. Although it would be quite obvious to assume that massive transactions with big fees are the ones that miners prefer to include into blocks, this idea is quite wrong. Smaller transactions are easier to validate, so miners prefer to work with smaller transfers (you can, however, set up the priority of those, too).

How does Bitcoin network fee get calculated?

Network fees, first of all, depending on the transaction size. As every block is limited to ~1 MB (and only around 2000 transactions or less can squeeze in it), you will have to pay more for sending bigger transfers. Another important detail here is the network load. With a higher demand for Bitcoin, the fees increase as more transactions are waiting to be processed. Several more factors are influencing the amount of BTC you pay in fees. Here are some of them:

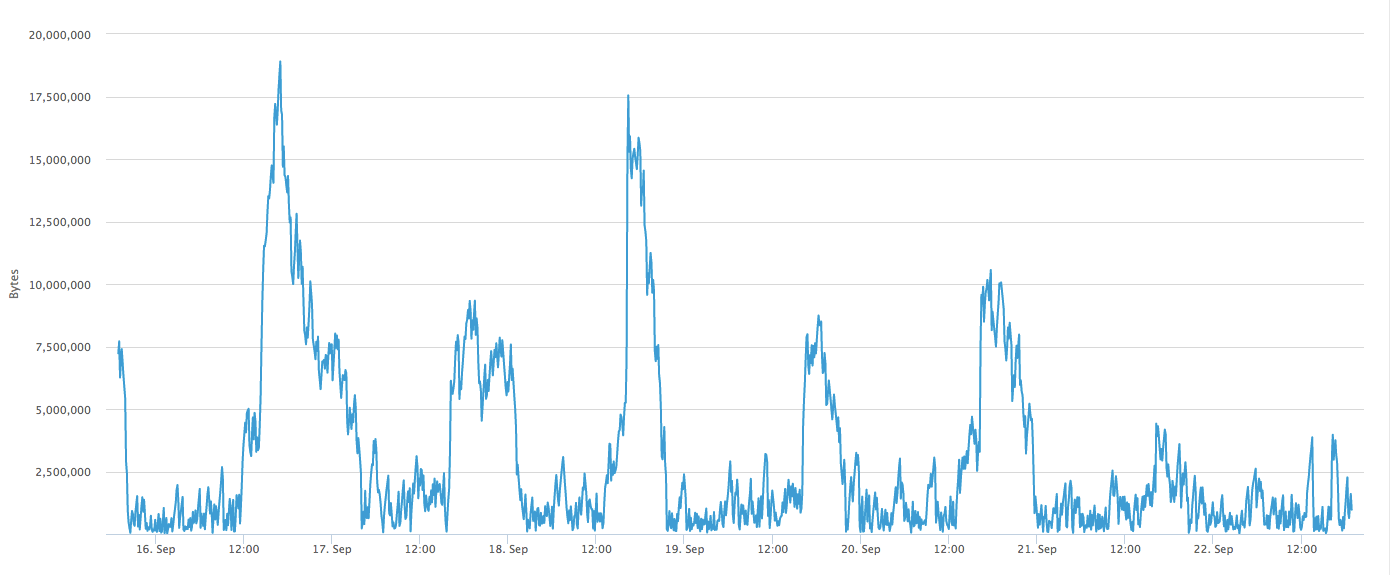

Bitcoin network load

As we have already mentioned, the demand for Bitcoin transactions at the moment of sending is crucial for the fee formation. Let’s see how it all goes here. When a new Bitcoin transfer is presented to the network, it gets verified by all the available Bitcoin nodes. After the verification is done, it goes to the Mempool (Memory Pool). This is an area where unconfirmed transactions wait for their turn. The miner needs to pick a transaction up from there and include it in the upcoming block. Traffic jams can happen in the Mempool – if there are too many transactions dropping into the pool, it might take a while for the miners to include all of them into blocks. Usually, if a transaction rests in the Mempool for more than 48 hours, it would be dropped and the funds would be returned to the sender’s wallet.

As we have already mentioned, the demand for Bitcoin transactions at the moment of sending is crucial for the fee formation. Let’s see how it all goes here. When a new Bitcoin transfer is presented to the network, it gets verified by all the available Bitcoin nodes. After the verification is done, it goes to the Mempool (Memory Pool). This is an area where unconfirmed transactions wait for their turn. The miner needs to pick a transaction up from there and include it in the upcoming block. Traffic jams can happen in the Mempool – if there are too many transactions dropping into the pool, it might take a while for the miners to include all of them into blocks. Usually, if a transaction rests in the Mempool for more than 48 hours, it would be dropped and the funds would be returned to the sender’s wallet.

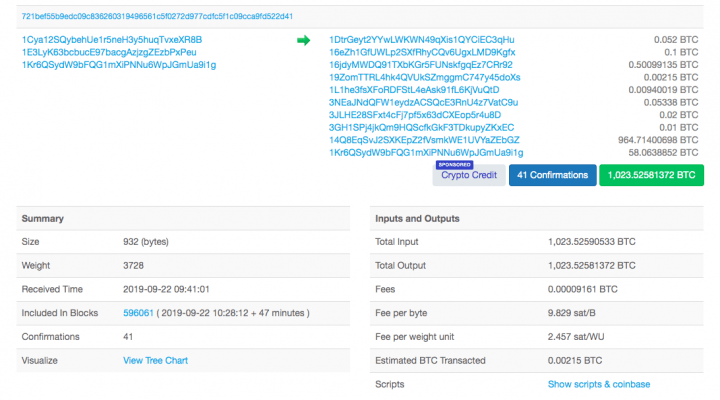

Inputs and outputs of a transaction

The number of transactions your Bitcoin address has ever received and the whole sum of BTC you own is called “inputs”. When you send BTC to some other address, some inputs of the transactions you have made in the past are being sent to the recipient, too. The inputs are collected together to become an output.

The number of transactions your Bitcoin address has ever received and the whole sum of BTC you own is called “inputs”. When you send BTC to some other address, some inputs of the transactions you have made in the past are being sent to the recipient, too. The inputs are collected together to become an output.

Using Multisig

In case you are using a multi-signature wallet (a wallet allowing providing addresses to multiple parties), the transaction size increases and so does the fee. This happens because multisig requires several signatures before signing the transaction as a whole.

Can I make Bitcoin transaction fees smaller?

Good news – yes, you can. First of all, Guarda Wallet offers fee customization in the “Advanced Options” of each transaction. Depending on your needs, you can tailor the fee from low (and wait a little longer for your transaction to get processed) to pretty much lightning-fast (but with a bigger fee, obviously).

Also, there is an option to make fewer inputs. Do not operate small suns in BTC – the less data you have in your transaction history, the lower your fees will be. Monitoring the Mempool helps, too – wait for the network to be less loaded and send your transaction out with a smaller fee.

How does Ethereum network fee work?

Unlike Bitcoin, Ethereum network fee is paid not in ETH but in a separate asset – Gas. Gas measures the amount of computational effort needed for the operations performed on the blockchain. The heavier the smart contract, the more Gas you will need. Just sending ETH is pretty cheap – this is a very simple and basic action not requiring lots of effort from the calculation side. However, when it comes to sending Ethereum-based tokens, things can get pricier. As tokens require running heavy contracts, much more Gas will be needed to make a transaction.

Regulated fee feature in Guarda Wallets

To make the process of sending crypto transactions even smoother, we have rolled the regulated fee feature out. See how it works:

- When sending a transaction, go to the Advanced Options

- Choose the fee that you would like to pay depending on your needs. Need to make a transfer ASAP? Increasing the fee would help! Your transfer can wait, but you would like to pay a smaller network fee? No problem! Set the fee to the very minimum.