Introduction

The emission of traditional currencies like the US dollar or Euro can be endless. Due to the issue of new banknotes, they gradually lose their real value, this phenomenon is called inflation. By its key characteristics, Bitcoin resembles real gold. The maximum number of coins is strictly limited. A total of 21 million bitcoins will be mined.

Bitcoin Mining

Bitcoin has no central regulator. Inflation is controlled by a special cryptographic algorithm, which records each released coin number and time. Every 10 minutes, miners generate a new block. Each block contains all the data about new transactions and holds data regarding previous blocks.

Miners have to solve a mathematical task, which requires significant computational power to create a new block, a miner receives a payment from the network for a new block generation. Every 210 000 blocks that take about 4 years to produce, the amount of remuneration or issue is decreased in half. It’s called the halving.

Miners were initially given 50 BTC for every new block. After the 2012 BTC halving the reward was reduced to 25 BTC. Also, in 2016 the payout was cut to 12.5 BTC. The third Halving will take place in May 2020, and the reward will be 6.25 BTC. The last Bitcoin is going to be mined in 2140. Miners will be taking 0,000000005820766091 BTC as a reward for a newly generated block. The profitability of mining is affected by the price and volume of transactions in the network.

To ensure the stability of the Bitcoin network, Satoshi Nakamoto developed an algorithm: mining complexity decreases or increases in proportion to the activity. After halving, some of the miners may consider the mining is unprofitable and refuse it, the network hashrate decreases, then the mining difficulty will go down. Intervals for new blocks adding to the blockchain will remain the same, so the transaction processing speed will not decrease.

In other words, Bitcoin hashrate is a parameter that characterizes the speed of solving mathematical tasks by devices that are involved in the mining of new blocks running on the Proof-of-Work (PoW) algorithm. This is a measure of the mining equipment performance. Bitcoin hashrate is affected by the number and performance of network-connected equipment; Bitcoin price; tariffs for electricity; Bitcoin popularity; release of new mining equipment.

The essence of PoW algorithm is that miners try to generate a new block, competing in the computing power of their equipment. The first miner who finds the right solution to the mathematical task produces a new block. The main drawback of PoW is that miners need to constantly increase their computing power as the number of transactions in the network grows.

The critical goal of Bitcoin halving is to increase the difficulty of mining and its emission distribution for the next 120 years. Halving makes Bitcoin harder to obtain, and its hyperinflation is regulated. Such facts represent a positive effect on its market price.

History of hashrate changing

2012

The network capacity is gradually growing (in proportion to the movement of Bitcoin price) and by the time of the first Halving reaches 29 TH/s. After halving, some of the miners left the market, and hashrate dropped to 18 TH/s in just 2 weeks.

2016

At the end of January 2016, hashrate reached 1 EH/s (1000 PH/s). Bitcoin price doubled this year (from $ 500 to $ 1,000). The same thing happens with computing power - by December, it doubled, and the mark of 2 EH / s was overcome. At that time, the miners didn’t pay attention to the second Halving and continued to increase their equipment computing power.

Bitcoin patterns

There are three main questions the community is interested in: How does Bitcoin price behave before halving? Does it grow up after halving? What is the Bitcoin price going to be at the end of 2020?

A Bitcoin growth model based on financial market patterns.

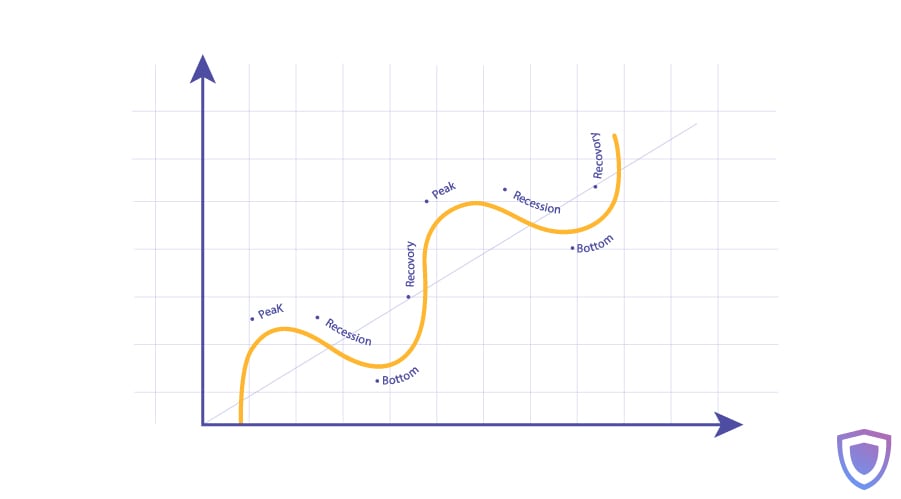

Charles Dow - the “father” of technical analysis, wrote that history is always repeating itself. This refers to every model and the economic system. The growth is often followed by the decline and the bottom, then growth and reach a new peak after the bottom. Four primary economic cycles exist:

- Kitchin cycle (2-4 years)

- Juglar cycle (7-11 years)

- Kuznets cycle (11-25 years)

- Kondratiev cycle (45-60 years)

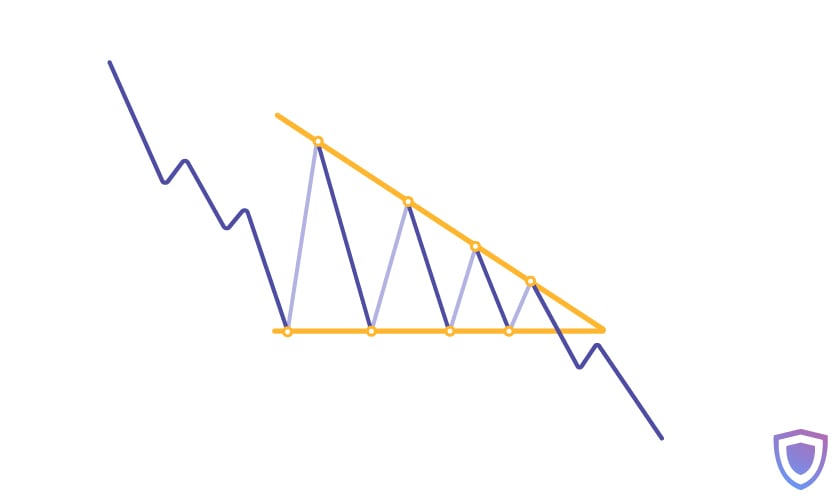

Kitchin cycle is a short-term economic wave usually lasting from 2 to 4 years. This period related to the volatility of the world gold reserves. When Bitcoin was founded by Satoshi Nakomoto, he developed a model similar to gold mining. This self-sustaining model allows for reducing the emission of coins every four years. Bottom, recovery, peak, recession - the entire economic cycle will take four years from halving to halving. This model looks like the Kitchin cycle.  This pattern is typical of Bitcoin before and after each Halving. The scenario was always the same: peak, recession, bottom, price recovery and then halving process. The price of Bitcoin jumps to its highest. Upon hitting its top, Bitcoin drops under the rules defined in the model of technical analysis called “descending triangle”. Before plunging through the level of support, the price bounces back a couple of times and then moves down to its bottom.

This pattern is typical of Bitcoin before and after each Halving. The scenario was always the same: peak, recession, bottom, price recovery and then halving process. The price of Bitcoin jumps to its highest. Upon hitting its top, Bitcoin drops under the rules defined in the model of technical analysis called “descending triangle”. Before plunging through the level of support, the price bounces back a couple of times and then moves down to its bottom.

Bitcoin halving History

The price always returns to the average point deriving from the previous peak. The extra time before halving is where the price shifts in different directions, but before halving it returns to the average of the prior peak value. Bitcoin begins to grow after halving and soon conquers a new peak. Bitcoin trades sideways during the remaining time, but before the next Halving, it returns to the average value. Bitcoin begins to rise again to a new peak-level after the Halving.

2011 — 2013

Bitcoin hit its first high ($32) in June 2011, then immediately followed by a recession. The fall occurred within the descending triangle pattern. The price for Bitcoin was dropping, and the line of support was around $8. After the breakdown, the cost ran to the bottom of $2. Following that, the recovery cycle began, and the price went up to about $15. By the next half, the coin was trading sideways, but on Halving Day (28 November 2012) the BTC price was $12.25, which was close to the average rate. Thirteen months after the first Halving, Bitcoin reached its new peak value.

2013 — 2016

During the next period between halvings from December 2013 till July 2016, the Bitcoin move pattern was the same (peak, descending triangle, then the bottom, recovery to the average value, halving process, and finally peak). Around the time the peak price was $1,177, $163 at the bottom, and $784 on the average. The price was about $660, before halving on 9 July 2016. During 17 months after the halving Bitcoin reached its peak again.

2017 — 2020

Bitcoin hit its all-time high of $19,794 in December 2017, followed by the recession, bottoming at $3,148 and recovery. The average price of the previous high is $13,830.

Halving Summary

Generally, the difference between the recovery price and the halving-day price is between 9-10%. The recovery price in 2012 was $15, representing 46.87% of the previous high ($32). Halving day prices were above $12, or 37.5% from the $32 peak. The gap is 9.37% between these two marks.

In 2016, the recovery price was $784, or 66.6% from the previous peak ($1,177). The price on the halving day was $665, or 56.49% from it. The difference between them is 10.11%.

The Crypto community could expect a possible Bitcoin growth model that predicts a new peak after the 2020 halving.

Bitcoin Halving will reduce the profitability of mining. Old ASICs will not cope with the mining tasks, but the latest models will be profitable. Halving is embedded in the BTC source code, and serious miners knew about it. Mining is a long-term investment, demand for Bitcoins will gradually increase, and this is facilitated by the halving process. A price chart for the last 8 years indicates its usefulness for the network. If Halving were not carried out, the miners would have already mined all BTC.