There is an ongoing debate around both strategies. Is the gradation of six months cycles correct? And if so, what factors are behind these dynamics and durations? And finally, how do these principles relate to the efficient market hypothesis?

What is the Halloween effect?

This phenomenon originated in 1694 in Great Britain and was statistically applied in 35 of the 37 countries analyzed in the regular stock market.

For example, Black Monday, Tuesday, and Thursday in the stock market in 1929, which marked the beginning of the Great Depression. Just as Black Monday occurred on October 19, 1987, this was also the day the Dow Jones Industrial Average fell the most in its history, by 22.6%.

This event did not only affect the USA but quickly spread around the world. Thus, by the end of October, the stock markets lost:

- Australia - 41.8 %,

- Canada - 22.5 %,

- Hong Kong - 45.8 %,

- Great Britain - 26.4 %.

At the same time, however, no important news or events preceded the crash; there were no visible reasons for it. This event called into question many important assumptions underlying modern economic science, put forward by the Austrian economic school: the theory of rational human economic behavior, the theory of market equilibrium, and the efficient market hypothesis. It was in the context of these situations that the concept of the “Halloween Effect” or the “October Effect” was formed.

Is there a scientific basis for the ‘Halloween Effect’?

Therein lies the most interesting thought: no. There is no statistical evidence to suggest that stock markets are suffering losses this month. Notwithstanding the above, it has been several days since the beginning of the month, and stock markets have experienced several consecutive declines, the dollar has strengthened, and volatility, in general, has increased significantly. One of the most commonly used indicators by market participants is the VIX, which reflects the volatility of the S&P500 stock index, which is up 30 percent from mid-September to the present.

The only study that has been done is an investigation by the International Journal of Financial Research, which shows that between 1980 and 2017, the vast majority of companies included in the Dow Jones Industrial Average experienced a Halloween effect in at least 22 of the 37 years analyzed. Caterpillar and Walt Disney were the most successful in this regard. A major equipment manufacturer and a media company experienced the Halloween effect in 29 of the 37 years analyzed, which means that the percentage of years with a Halloween effect is 78.3%.

Why do leading economists find it difficult to justify this effect?

However, scientists find it difficult to justify this, because theoretically, if markets were really efficient, such profits could not be possible for such a long time. In reality, more and more market participants would take advantage of this, thereby offsetting the effect of the deals made. However, as professionals, we know that not all market participants always act rationally and that their goals and motives may be very different.

For example, it may happen that the demand for stocks is consistently higher in the winter months than in the summer:

- Strategic business decisions and investment decisions are usually made between November and April, with more corporate income being created during this time.

- Cash flows are minimal during the summer months and continue through the winter months.

- The frequency of news in summer is lower than in winter (fall).

- Liquidity is lower in the summer months because the number of market participants is much lower. As a result, trading volumes fall and there is less interest in accessing falling stocks.

Can you consider the effects of Halloween when planning an investment?

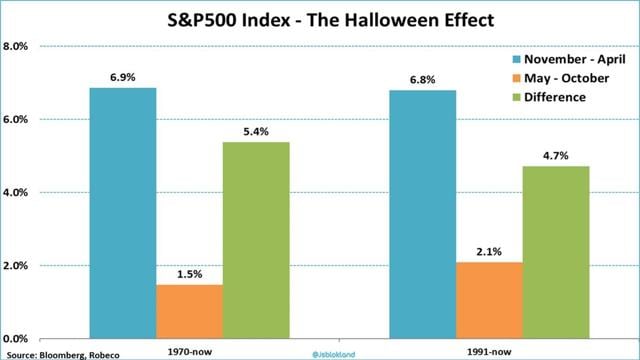

An important question, to which everyone must find the answer himself. For example, we can consider the theory of Carlos Lissagar, who is a successful author and financial markets analyst. He believes that in this figure we can trace a very interesting trend in the example of the behavior of the S&P500.

You can see that from 1970 to 2017, the difference in growth from November to April is much higher than from May to October. The same is true from 1991 to 2017, where you can isolate the dynamics from November to April.

You can see that from 1970 to 2017, the difference in growth from November to April is much higher than from May to October. The same is true from 1991 to 2017, where you can isolate the dynamics from November to April.

What’s unusual about the years 2020-2021 regarding the market and its trend?

In that sense, there is no doubt that this year was atypical, as in the past. 2020 is a pandemic year with a big economic downturn and 2021 is a year of recovery. Earlier this year, there was not much visibility of how fast the recovery could be. Although most countries implemented unprecedented fiscal and monetary incentives in 2020, Covid-19 variants continued to multiply with higher infection rates, and vaccine introductions had just begun, developed in record time, with very long trial periods.

How might this concept affect trading in 2021?

The Halloween effect is not a guarantee of success in investing in the financial markets, much more knowledge and analytical skills are required to achieve good results. But it is good to understand that traders can count on the Halloween strategy as one of the analysis tools when investing.

How does the Halloween effect apply to the cryptocurrency market?

While within the day and short-term traders may well be able to exploit the Halloween effect, the results of the research couldn’t help practicing investors, as they do not allow for a stably working business model with predictive value. In addition, most crypto investors will not be able to make stable profits if they apply strategies that involve trading only during a certain period of time. Given the empirical anomaly of this pattern, continuous strategies are needed to work it out.

What do traders do during the Halloween effect?

To implement the Halloween strategy, they buy the S&P 500 in early November and hold the position until the end of April. During the 6 months from May through October, this approach does not involve investing and makes them hold. In the Ultimate strategy, futures are bought on the 26th of each month. If that day falls on a weekend or holiday, the purchase date is moved to the next trading day.