Revealing the veil of secrecy about Tesla investments

Satoshi-era coin movements, strange behavior of Elon Musk and expensive Ethereum fees: revealing the news agenda for the week

Over the past few months, institutional investors, hedge funds, and private entrepreneurs have made a significant leap in the approval of digital finance. The first cryptocurrency, on par with tech-savvy altcoins, has attempted unprecedented growth and firmly established itself as the first level in terms of capitalization among all altcoins.

Elon Musk called Tesla’s investment in bitcoin “reckless,” and then changed his Twitter icon to the logo of the first cryptocurrency.

The head of Tesla said the $1.5 billion investment in Tesla was reckless. According to him, it has no place for an S&P 500 index company. Also, he said Tesla’s actions don’t reflect his views on what’s happening in the cryptocurrency market, but bitcoin is “simply a less foolish form of liquidity than saving in cash.”

Tesla’s action is not directly reflective of my opinion. Having some Bitcoin, which is simply a less dumb form of liquidity than cash, is adventurous enough for an S&P500 company.

— Elon Musk (@elonmusk)

February 19, 2021

“When a paper currency has negative real returns, only a fool wouldn’t look for something to replace it. Bitcoin is almost as much nonsense as paper money. The keyword is “almost,” Musk wrote on Twitter. “To be clear, I’m not an investor, I’m an engineer”, Musk stressed.

The day after, however, the Tesla CEO changed his Twitter account avatar to an image of a bitcoin logo.

“It’s just for one day”, Musk wrote.

It is worth noting that Musk has experience influencing cryptocurrency rates. The head of Tesla actively promotes the cryptocurrency Dogecoin on his Twitter. At the beginning of February, he published several posts on Twitter about it and the cryptocurrency rate doubled as a result. On February 15, Musk called the only problem of Dogecoin its high concentration on a few addresses. The entrepreneur said that he was ready to pay large altcoin holders if they sell most of their coins. Create your own Dogecoin wallet with Guarda.

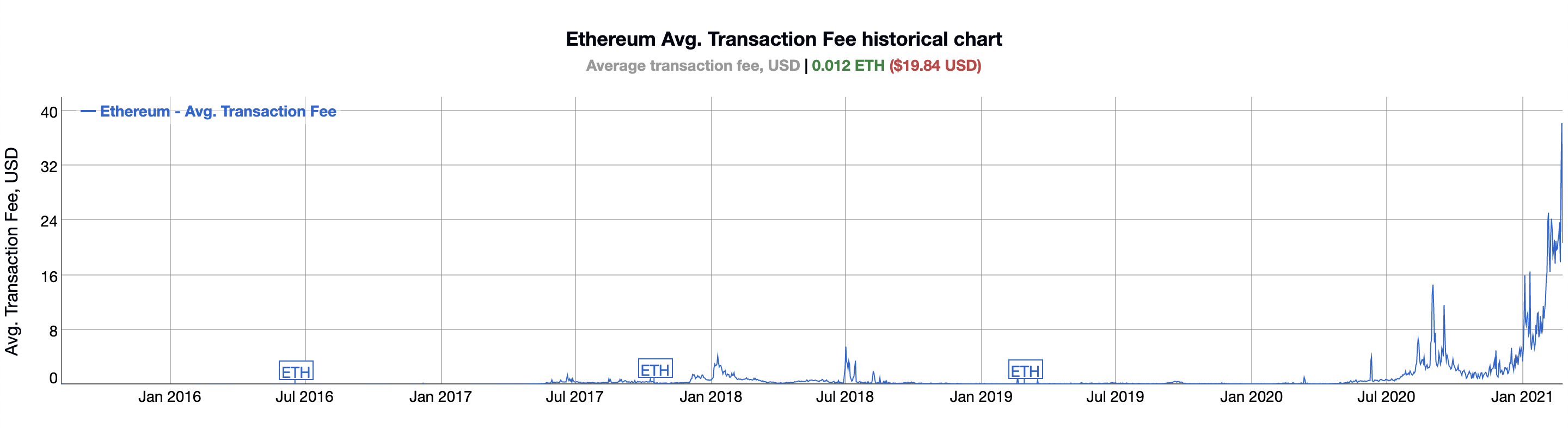

Commissions within the Ethereum network hit a record high

The average transaction fee on the Ethereum network is currently $17, and can sometimes go as high as $30, according to the BitInfoCharts website.

At this level, any user might ask themselves: what’s the point of performing a transaction that consumes almost all of the profits as the price of the cryptocurrency rises?

So far, the large increase in Ether (ETH) fees has not led to a noticeable drop in the number of active addresses. In fact, Ethereum usage remains close to record highs despite commissions, at least for now, indicating high demand for use of the network.

Anticipated changes and hope for improvements in Ethereum are embedded in its version 2.0, which means moving from Proof of Work to Proof of Stake, but this seems increasingly distant as its full integration could take years. While all of this is coming, EIP-1559 emerged as an initiative to address high fees. This is an option that Vitalik Buterin has been talking about for months and may finally become a reality soon.

Pizza delivery driver will cash in bitcoin tips that have been lying around since 2013

A delivery driver who had been storing tips in the first cryptocurrency since 2013 decided to exchange the coins for dollars. This was reported by a Reddit user.

Just gave the pizza guy a paper wallet as a tip (0.0069BTC ~ $5) with instructions and email address if he needs help – went better than expected! from

r/Bitcoin

According to the first post, on December 28, 2013, the customer offered the pizza delivery driver a choice of tips between $5 cash and 0.0069 BTC (~$5 at the exchange rate at the time) in a paper wallet. At the exchange rate at the time of writing, the tip is about $320

7 years ago, I gave a pizza guy a $5 tip in BTC (.05 BTC at the time). That $5 tip is now worth over $2850. Today, I received this. from

r/CryptoCurrency

He chose the second option and received public and private keys along with instructions and a Reddit user email. Seven years later, the delivery man contacted btcbible to help him exchange bitcoins for U.S. dollars.

The crypto exchange will go public for the first time. It’s valued at $100 Billion.

Within the next month, Coinbase, the largest U.S. cryptocurrency exchange, will become a public company. Coinbase will go public on the NASDAQ exchange bypassing the IPO process, through a direct listing. It will become the first traded crypto exchange in the history of the industry.

In January, the company launched a share sale on the Nasdaq Private Markets platform to price the offering.

On Jan. 29, 75,000 shares of the company were sold at $200 per share, giving Coinbase a valuation of $54 billion-although by the end of the 2018 venture funding round, the valuation was only $8 billion. In early February, Coinbase sold several more stakes, most recently on Feb. 19, at $373 apiece. The company now has a valuation of $100.23 billion. As Axios notes, Coinbase could go public with its highest valuation since the Facebook IPO. Coinbase’s preliminary valuation exceeds the capitalizations of major exchanges and banks.

Coinbase will go public bypassing the IPO procedure. Unlike IPO, the company in this case does not issue new securities. Existing shares of investors and employees are sold on the stock exchange. According to the analysts, this reduces the cost of services of investment banks.

Coinbase president Asiff Hirji first spoke about an IPO back in December of 2017. When asked about the possibility of taking the company public, he said:

$5 million in Satoshi era bitcoins moved for the first time

The 100 bitcoins that were mined in June 2010 were moved for the first time today, according to Blockchair, also cited by U.Today. As of this writing, they are valued at about $5 million.

Antoine Le Calvez, a data engineer at CoinMetrics, tweeted that transactions involving coins from the CPU mining era are “very rare.”

Some old coins moved today (100 BTC from June 2010).

It’s very rare to see pre-GPU era bitcoins move, it only happened dozens of times in the past few years.

And no, it’s probably not Satoshi.

pic.twitter.com/0jZXnmWUes— Antoine Le Calvez (@khannib)

February 24, 2021

This isn’t the first time this has happened. In October 2020, DiarioBitcoin reported that several bitcoins, worth about $11 million at the time, had moved after 10 years of inactivity. Because the bitcoins were mined in 2010, some at the time speculated that they might belong to Satoshi Nakamoto himself or the bitcoin creator’s inner circle.

MicroStrategy buys nearly 20,000 BTC for $1.026 billion

MicroStrategy CEO Michael Saylor announced that the company purchased an additional 19,452 bitcoins (BTC) for $1.026 billion at an average price of $52,765.

MicroStrategy has purchased an additional ~19,452 bitcoins for ~$1.026 billion in cash at an average price of ~$52,765 per

#bitcoin. As of 2/24/2021, we

#hodl ~90,531 bitcoins acquired for ~$2.171 billion at an average price of ~$23,985 per bitcoin.

$MSTR

https://t.co/FbsRYhXEhn— Michael Saylor (@michael_saylor)

February 24, 2021

As of Feb. 24, the company has 90,531 BTC that were purchased for $2.171 billion at an average price of $23.985 per cryptocurrency, Saylor said in a tweet.