Crypto Loan | Everything You Need To Know

[DEPRECATED]

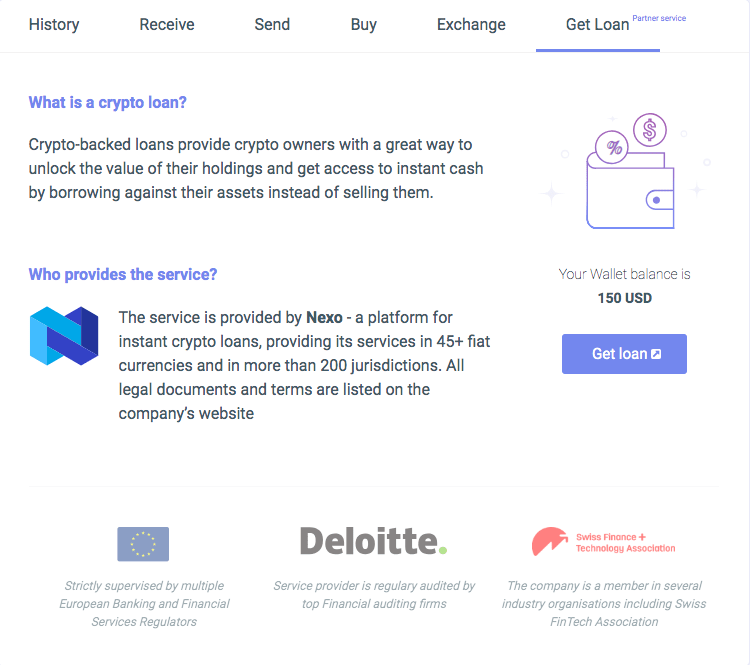

In the light of our newest partnership with Nexo, Guarda wallet breaks down the basics of cryptocurrency loans and finds answers to the most important user questions. The crypto loan feature is already available in Guarda wallets.

The cryptocurrency-backed loan is the new black

Now, Guarda wallet offers an opportunity to get loans collateralized by your cryptocurrencies. This sounds great, but what does it really mean? The answer is: we will give you cash if you give us your Bitcoin BTC, Ethereum ETH, Litecoin LTC, or another cryptocurrency of your liking as security. Quite simple, right? This is the way it works.

Powered by Nexo, Guarda users can now apply for a loan in a matter of a couple of clicks.

What is a crypto loan, exactly?

The cryptocurrency-backed loan is a way to get instant cash for your crypto without giving up the assets. Cryptocurrency loan platforms are services, allowing their customers to put crypto coins as collateral and borrow fiat money as a ratio.

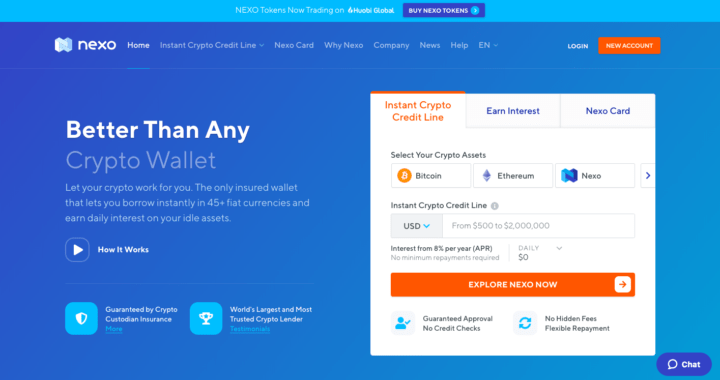

What is Nexo?

Guarda wallet partnered with Nexo to bring the cryptocurrency loans into our wallets. Here is what you need to know about our partner-service:

Nexo is a company with over 10 years of experience in the FinTrech area. From 2007, the team was working on providing services in the following areas:

- Instant Online Consumer Loans

- E-commerce Financing

- Bill Payment Services

More information on the team and the market success of this company can be checked on their official website. Guarda is happy to have this partnership and provide new possibilities for our users.

Why apply for a crypto loan?

Possibly, the majority of the crypto hodlers have a long-term perspective on their coins and tokens. Sometimes, however, there are situations that force passionate investors to sell their crypto assets for fiat. For example:

- you would like to buy a house

- pay your debt

- fund your new startup

- you just need cash at the moment

All of these abovementioned things imply that you need to have fiat money ASAP. Obviously, the easiest way to get cash right away is to sell your crypto. This idea is hard to comprehend for long-term cryptocurrency holders. This is why we want to have cryptocurrency loans.

What is collateralized lending?

Collateralized loans are very popular. You can leverage various assets and securities to be your collateral. If you ask us what is the point of collateral – here is a simple answer:

The collateralization of your loan limits the risk exposure.

As we all know, the cryptocurrency market is a very volatile space. It can happen that the value of your collateral will decrease – then the lender can liquidate some part of the collateral and stabilize the loan. Having a collateralized loan means a win-win scenario for both sides – the lender is holding the collateral and sleeps tight and the borrower gets to leverage the value of the crypto investment. Once the loan is paid back, you get your coins back into your Guarda wallet, too.

How to get a crypto loan on Guarda? [DEPRECATED]

Customers can get a loan in the comfort of their Guarda wallet. All you need to do is to go to the Crypto Loan section guarda.com and press Get a Loan.

Afterward, you will be redirected to the website of our partner service NEXO where you can proceed. You can get over 45 fiat currencies instantly and even earn daily interest on your assets.

You can follow Nexo and Guarda on social media to know all the updates on the new feature.